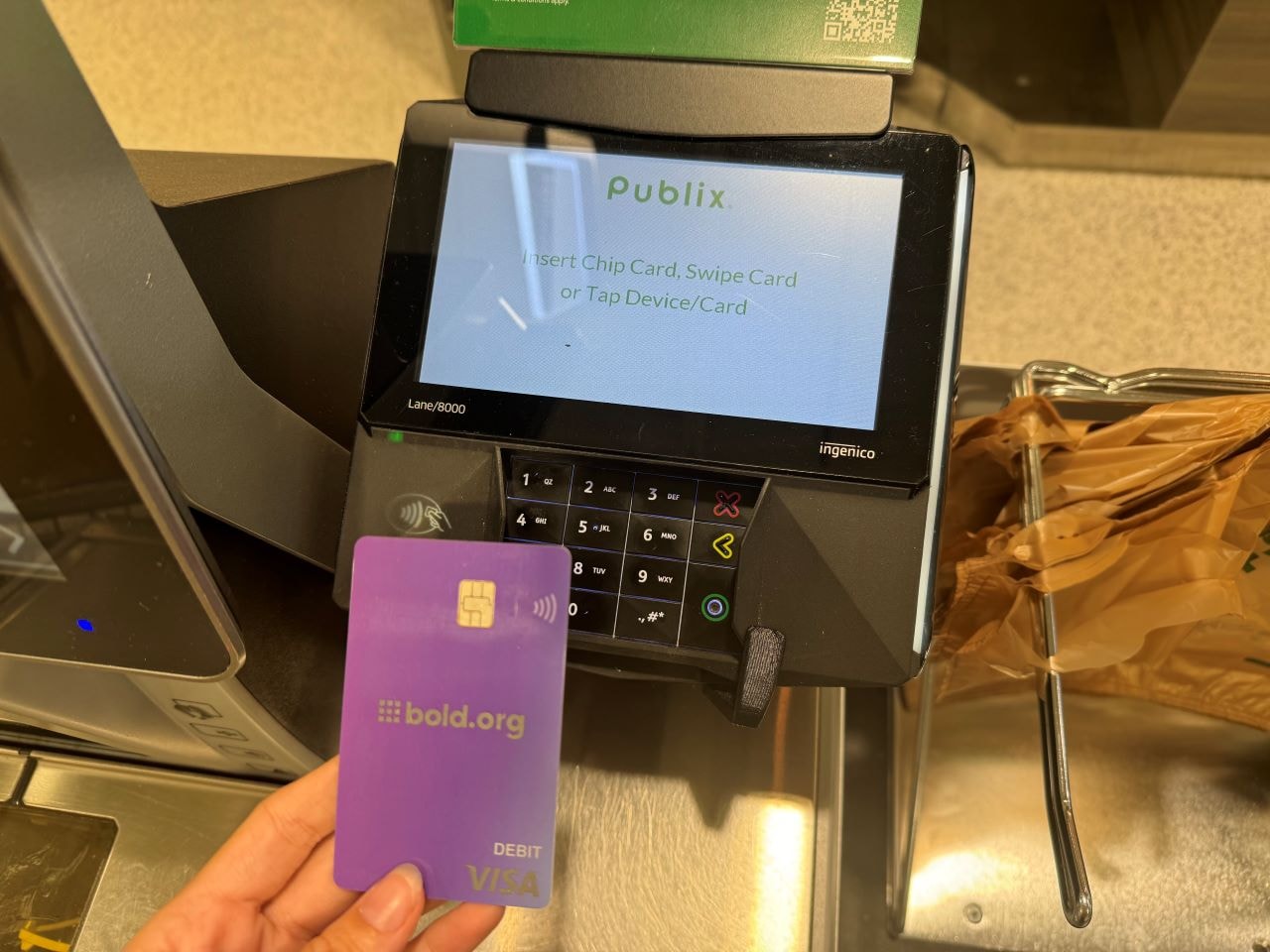

The Bold Debit Card is a legitimate debit card designed primarily for students and recent graduates. It is particularly beneficial for those who want to make the most out of their spending by earning rewards1 that help cover educational costs, including student loan payments.

As a college graduate with significant student loan debt, I’ve found this debit card to be a great resource for managing my finances and earning rewards that help me pay for school.

One of the most valuable features of the Bold Debit Card is the ability to accumulate Bold Points1 on purchases. This means you’re not just spending money—you’re actively turning everyday spending into a tool that helps you pay for your education. Whether you’re buying school supplies, paying for tuition, or grabbing a coffee, these points can add up and really make a difference.

The key advantage? It’s not only about spending smarter; it’s also about leveraging your everyday purchases to help support your education. The more you use the debit card, the more Bold Points you earn, helping you offset school expenses or even access new scholarship opportunities.

Learn more about the Bold Debit Card today and see how it can help you manage your money, earn points, and reduce your student debt.

My Experience With the Bold Debit Card

As a college graduate who uses the Bold Debit Card regularly, I’ve found it to be an invaluable tool for helping me manage my finances. What I appreciate most about the rewards system is how it’s designed to support students and graduates like me. With every eligible purchase, I earn Bold Points,1 of which I can directly apply toward my student loan payments.

With a substantial student loan balance, this feature has been incredibly useful, helping me strategically reduce my financial burden and making a real impact on my long-term financial health.

The combination of flexibility and a focus on supporting students’ financial goals makes the Bold Debit Card a great choice. For anyone managing the costs of education, this debit card provides a practical and effective way to make every dollar count.

For more information about rewards, check out Bold.org’s debit card rewards page.

What is the Bold Debit Card and How Does it Work?

The Bold Debit Card is a demand deposit account designed specifically for students and graduates, offering a variety of features that help with financial management and student debt. Users can set up direct deposits, connect other bank accounts, and transfer money.

A unique feature of the Bold Debit Card is the ability to receive Bold.org scholarships directly onto the card,2 giving you more control over how your scholarship funds are used. Plus, you earn Bold Points from everyday purchases like tuition payments or buying books. The debit card can also be added to your mobile wallet, enabling quick and secure contactless payments.

The Bold Debit Card has no hidden or annual fees. Learn more about the debit card’s fees.

Key Features and Benefits of the Bold Debit Card

Bold Points1

Bold Points can be earned by using your Bold Debit Card or by interacting with the Bold.org website, such as applying for scholarships, leaving reviews, referring Bold.org to others, or submitting surveys. This means there are many opportunities to earn Bold Points to increase your rewards. These points can then be redeemed for cashback, student loan payments, or unlock scholarships, offering numerous ways to benefit from your spending.

Cashback or Student Loan Payments1

With the Bold Debit Card, you earn 1 Bold Point for every $2 spent on eligible purchases. For example, if you accumulate 4,000 Bold Points, you have the option to redeem them for $40 in cashback. Alternatively, those same 4,000 Bold Points can be applied as a $60 payment toward your student loans. This system allows you to make your everyday spending work for you, whether you aim to get a little extra cashback or reduce your student loan debt.

Customer Service and Security Protections

The Bold Debit Card is backed by strong security measures, including FDIC insurance up to $250k3 and robust anti-fraud protections. Additionally, whenever you have questions or require assistance, customer service is just a call or message away.

Receive Your Scholarship on the Bold Debit Card2

A notable feature of the Bold Debit Card is the option to have your Bold.org scholarships deposited directly onto the card rather than sent to your school.

This gives you more flexibility in using your scholarship funds for what matters most to you—whether it’s textbooks, supplies, or other college-related essentials. Although there are some restrictions on spending, this option allows you to manage your educational finances with more control, allowing you to allocate resources according to your specific needs.

Learn the differences between college scholarships and financial aid to better understand your funding opportunities!

Other User Reviews and Testimonials

These testimonials are from other actual users of Bold.org who have interacted with the Bold Debit Card and have shared their personal experiences:

“Overall, my experience with the card has been great. The activation process was simple and easy. Cashback for my student loans is the feature I find most useful. Based on my experience so far, I would recommend the card to friends and family.” – Amanda B.

“The activation process was beyond easy to do. I had no problem activating my card. I have only redeemed Bold Points once so far, and it felt awesome to get a little extra money in my account. It’s a great way to earn extra money towards student loans or whatever anyone wants to use it for.”– Aimee L.

“I’ve enjoyed the Bold Debit Card so far! I would recommend the Bold Debit Card to fellow students!” – Isaac O.

The testimonials featured were gathered from interviews with Bold.org users who actively use the Bold Debit Card. The personal experiences of these individuals are shared to provide insights into the functionality and user experience of the Bold Debit Card. Individual experiences may vary. No student received compensation to endorse the Bold Debit Card.

Is the Bold Debit Card Right for You?

Managing the costs of education can be challenging, but I’ve found the Bold Debit Card to be a practical choice. It’s not just about earning points—it’s about using those points in a way that directly supports your financial health as a student or recent graduate. For me, the card has been effective in helping pay down my student loan debt while keeping daily expenses in check.

That said, it’s important to think about your own financial situation and spending habits. If you’re looking to reduce your student debt or get cashback on your purchases, the Bold Debit Card could be a great option for you, too.

My Final Thoughts

The Bold Debit Card has proven to be a reliable and helpful resource for me and for students looking to manage their finances and earn rewards1 that make a real difference. It’s safe, secure, and backed by a platform committed to supporting students with a mission to fight student debt.

By turning everyday purchases into opportunities to help pay for school, this debit card offers a practical way to make your spending work for you. Whether you’re still in school, working on your degree, or recently graduated, the Bold Debit Card can be a valuable tool to help you stretch your financial resources further.

If you’re considering the Bold Debit Card, I encourage you to think about how it might fit into your own financial strategy. For students looking to make the most of their money, the Bold Debit Card is definitely worth considering.

If you’re still curious about the legitimacy of the Bold Debit Card, I encourage you to explore Bold.org further and see what other students have to say.

Frequently Asked Questions

How do you make the most of the Bold Debit Card?

Students can make the most of their Bold Debit Card by using it for everyday spending, earning Bold Points, and redeeming them for cashback or student loan payments.1 Students can also benefit from using the card when they apply for multiple scholarships because the more Bold Points they earn, the more scholarship opportunities they can access, which increases their chances of winning scholarships. The card is a valuable tool for students to help manage their finances and achieve financial aid.

Is Bold.org one of the only scholarship platforms offering student banking services?

Yes. Bold.org is the only scholarship platform offering student banking services. Unlike other scholarship sites, Bold.org gives students the ability to manage their debit card and scholarships in one place.

Is Bold.org legit?

Yes. Bold.org is a legitimate scholarship and student banking platform. High school students, college students, and graduate students can create a free profile to showcase their unique interests and skills to donors. They have a dedicated scholarship panel and dedicated teams to support both donors and students. Every scholarship on the platform is vetted and exclusive, so you know the scholarships are real.

Bold.org also offers a scholarship search tool with a variety of opportunities, including no-essay scholarships. They also provide resources to guide you through the application process. With the introduction of the Bold Account with the Bold Debit Card, students have an additional avenue to save on college costs. Bold.org is a trustworthy resource for funding your education, with real people committed to helping students succeed.

Do Bold Points1 help me earn more scholarship opportunities?

Yes, earning Bold Points can unlock additional scholarship opportunities. Bold.org encourages students to apply for as many scholarships as possible to maximize their potential earnings. Some scholarships on the platform are related to Bold Points, while others are based on factors like GPA, financial need, demographics, and majors. One of the advantages of the Bold Debit Card is that while you accumulate Bold Points using the card, you also unlock scholarships. Even if you redeem your points for cashback or student loan payments, your all-time earned Bold Points do not diminish.

Bold.org Visa® Debit Card is a demand deposit account provided by Pathward®, N.A., Member FDIC. Bold.org Visa Debit Card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card can be used everywhere Visa debit cards are accepted. Visa is a registered trademark of Visa U.S.A. Inc. All other trademarks and service marks belong to their respective owners. Register your Card for FDIC insurance eligibility and other protections.

1. This offer is not a Pathward product or service. Pathward does not endorse this offer.

2. Receiving a scholarship on the Bold Debit Card is a service provided by Bold.org and is not affiliated with their Bank partners/Pathward®.

3. Funds are FDIC insured, subject to applicable limitations and restrictions, once Pathward receives the funds deposited to your account. For more specific and up-to-date information about coverage and limitations, see the FDIC website.

Sydney Zheng

Sydney, a native of Los Angeles, is pursuing a degree in Public Health at the University of California, Los Angeles. Her expertise in student financing enables her to navigate the complexities of funding her education while also offering insights to others on available financial resources. As a contributor at Scholarship Institute, Sydney writes about college finances to help fellow students better understand their options.