It’s no secret that a college education doesn’t come cheap. As of 2024, the average annual cost of college in the U.S. was $38,270. That’s more than double the cost of college in the 20th century, so it’s no wonder that student loan debt sits at $1.814 trillion. With such stark statistics, how can you minimize debt when you want to get a college education?

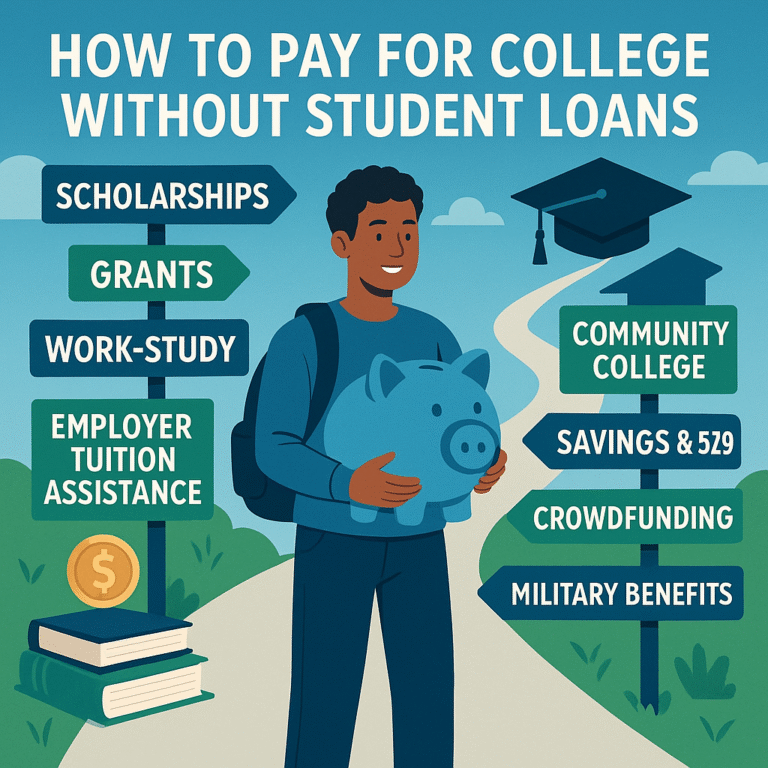

The answer is strategic financial planning. There are multiple financial aid options available, including grants, scholarships, and work-study programs that can help cover your college costs. Learn how you can maximize your financial aid and graduate with less student loan debt.

Understanding the Financial Aid Landscape

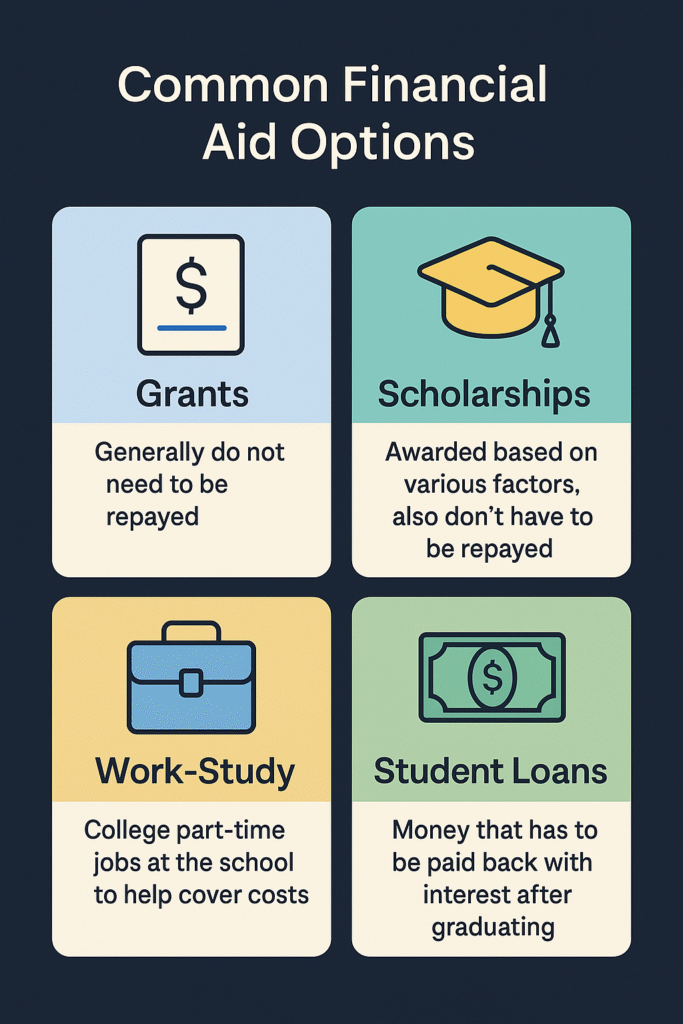

First, familiarize yourself with the various types of financial aid: grants, scholarships, work-study, and loans.

- Grants provide you with free money to cover your college costs. Generally, grants don’t need to be repaid once you graduate. They are often based on factors such as income, demographics, or area of study.

- Scholarships also provide financial aid to cover college expenses with no repayment obligation. They are often based on factors such as academic achievement, athletic status, demographics, gender, or area of study.

- Work-study programs provide students with part-time jobs while they’re enrolled in college to help cover their education expenses. Jobs are often on campus and allow you to gain experience, as well as help pay for college.

- Student loans provide funding for tuition, supplies, housing, and other educational expenses. Unlike grants and scholarships, loan funds must be repaid upon graduation.

Once you understand the different financial aid options available to you, submit a Free Application for Federal Student Aid (FAFSA) form or College Scholarship Service Profile (CSS Profile) to determine aid eligibility.

Grants: Free Money You Shouldn’t Miss

There are several types of federal grant programs, including:

- Federal Pell Grant

- Federal Supplemental Educational Opportunity Grant (FSEOG)

- Teacher Education Assistance for College and Higher Education (TEACH) Grant

You can apply for any or all of these grants—and you should, even if you’re not sure if you’re eligible, to maximize your financial aid.

Federal Pell Grants

This type of grant is offered to undergraduate students based on their family’s financial situation, which is determined through the FAFSA form. To qualify, you must be a U.S. citizen, U.S. national, permanent resident, or refugee. You’ll need a valid Social Security number and provide your tax information to determine eligibility.

For the 2024-25 academic year, Federal Pell Grants award up to $7,395 per student.

FSEOG

The FSEOG is similar to the Federal Pell Grant in that it’s awarded based on financial need. However, while the federal government administers Pell Grants, FSEOGs are administered by each participating school’s financial aid office. Not all schools offer the FSEOG.

For the 2024-25 academic year, the FSEOG awards $100 to $4,000 per year, depending on the student’s financial need.

TEACH Grant

TEACH Grants require you to commit to a teaching service obligation, and if you don’t fulfill that obligation, you must repay it as a loan, complete with interest. The grant helps cover the educational fees of students who plan to enter the field of teaching upon graduation.

For the 2024-25 academic year, the TEACH Grant awards up to $4,000 per student.

Scholarships: Merit and Need-Based Opportunities

Scholarships provide funding to pay for a student’s college education based on their academic history, athletic status, financial need, demographics, and other factors. There are several types of scholarships to consider:

- Institutional, such as university merit scholarships

- Private, such as those offered by corporations like Google or Coca-Cola

- Community-based, such as local scholarships or those intended for those with specific backgrounds

There are hundreds of scholarships available for which you can apply, making the process seem daunting. Begin your search on an online resource like the Scholarship Institute, where you can search for options tailored to your background and needs. You can also visit your college’s financial aid office to learn about the scholarships you might be eligible for. Here’s a more detailed breakdown of the types of scholarships listed above.

Institutional Scholarships

Some universities, like the University of Southern California, Boston University, and Vanderbilt, offer merit scholarships ranging from a few thousand dollars to full tuition coverage. Others, like Harvard or Princeton, don’t offer additional application scholarships and instead evaluate each student’s financial situation independently. When researching colleges, check to see whether your shortlisted schools offer their own merit scholarships that you can apply for to reduce your out-of-pocket costs.

The application deadline for these university-based scholarships tends to be earlier than the FAFSA deadline and often remains exclusive to early action (EA), restrictive early action (REA), and early decision (ED) applicants. Private universities that restrict applications to EA or ED can be combined with REA applications to universities like Yale, Princeton, or Harvard.

Private Scholarships

You should also know the specific requirements of the scholarship you’re applying for. Some might focus solely on your financial needs, while others may take merit and community service into account. Depending on the scholarship, you may need to start planning well in advance to meet the requirements.

Here are some of the top scholarships to consider and their specific requirements:

- Davidson Fellows Scholarship: You must complete a “significant piece of work” in science, technology, engineering, math, literature, music, philosophy, or outside the box.

- Doodle for Google Scholarship: You must create an original artwork that incorporates the Google logo based on an annual theme and submit a short artist’s statement.

- Coca-Cola Scholars Program Scholarship: You must demonstrate your ability to lead and serve, and your commitment to make a significant impact on your school and community.

Community-based Scholarships

Local scholarships often have a less selective application process, a higher dollar amount, and more flexible terms. However, searching for these scholarships is often a disorganized and tedious process. It’s wise to start your search at your school’s financial aid office, though you can also check with community organizations, your high school guidance counselor, your local library, and local businesses.

Bear in mind that scholarships can impact your overall financial aid package. Your total financial aid cannot exceed the cost of college. Therefore, your school’s office of financial assistance may subtract the amount of your scholarship from your cost of attendance before applying for a grant or other type of financial aid.

If you plan on applying for scholarships to pay for college, apply early. Some scholarships are offered on a first-come, first-served basis, so you could miss out by leaving it until the last minute. Some of the most competitive merit scholarships operate in rounds, with some closing as early as September, so it’s vital to plan ahead and know the deadlines for each scholarship you want to apply for. Many scholarships also require you to submit a personal essay alongside your application, and that’s not something you want to rush.

Work-Study Programs: Earning While Learning

The Federal Work-Study (FWS) program provides students with employment opportunities while they’re enrolled in college, helping to cover some of their educational expenses. This program is offered through each school’s financial aid office. Available jobs are often on campus in libraries, research labs, classrooms, or athletic departments. However, you may be able to secure an off-campus job if the work serves the public interest (such as a job at a private nonprofit or a public agency).

Participating in work-study programs has numerous benefits:

- It helps you pay for tuition, supplies, housing, and other educational expenses

- You don’t need to repay the money you earn

- It provides you with practical skills and work experience to bulk up your resume

- It can reduce your reliance on student loans

Strategic Planning to Maximize Aid

Simply applying for financial aid can help you get funds to help pay for college. However, strategic planning can help you maximize your financial aid, allowing you to reduce your overall student loan debt.

File Early

If you’re filling out the FAFSA, do so as early as possible to ensure consideration for certain first-come, first-served student grants. For the 2025-26 school year, the deadline is June 30, 2026. Bear in mind that the general filing date for the university’s financial aid application is often earlier than FAFSA; check with your school’s financial aid office to verify so you don’t accidentally miss a deadline.

Filing early can also put you ahead of other applicants. These days, many colleges have shrinking budgets and a decline in international student applications, resulting in financial cuts for every university. Submitting financial aid applications and prioritizing EA and ED to colleges of interest is more important than ever.

Consider Taxable Income

Your eligibility for income-based financial aid is based on your Student Aid Index (SAI)—formerly the Expected Family Contribution (EFC)—which determines the amount of money you and your family can reasonably contribute to your education. Consider how you can lower your taxable income to lower your SAI and maximize your aid.

Some common ways to do this include:

- Increasing contributions to a pre-tax retirement savings account, such as a 401(k) or a traditional IRA.

- Increasing contributions to your health savings account (HSA).

- Maximize your itemized tax deductions, if applicable.

- Claim all available tax credits on your tax return.

FAFSA splits assets into two categories: student and parent. However, most dependent students won’t have many assets to their name. Here’s what the SAI considers to be student and parent assets.

| Student Assets | Parent Assets |

| Money in student-owned checking and savings accounts | Money in parent-owned checking and savings accounts |

| Non-retirement investments owned by the student | Coverdell or 529 college savings plans |

| UGMAs and UTMAs | Non-retirement investments owned by the parent |

| Net worth of parent-owned business | |

| Net worth of second or vacation homes |

Note that FAFSA calculates eligibility using a base year that’s two years before college enrollment. That means any raises, bonuses, or windfalls reported that tax year will reduce your financial aid. With sufficient notice, families can use this information to postpone any major asset sales or larger taxable events until after the aid is submitted.

Combining Aid Options Effectively

You aren’t limited to just one form of financial aid. Instead, you can stack or layer grants, scholarships, and work-study programs to get the most possible aid and minimize your out-of-pocket college costs.

Scholarship stacking is when you layer multiple scholarships to help increase your overall financial aid. This can prevent you from taking out hefty student loans that you might spend decades paying off. However, scholarship stacking isn’t always allowed, so check with your school’s financial aid office. Your school may deduct your total external scholarship money from any internal scholarships you qualify for.

However, when done right, combining scholarships and grants can be highly effective.

Additional Tips to Reduce College Costs

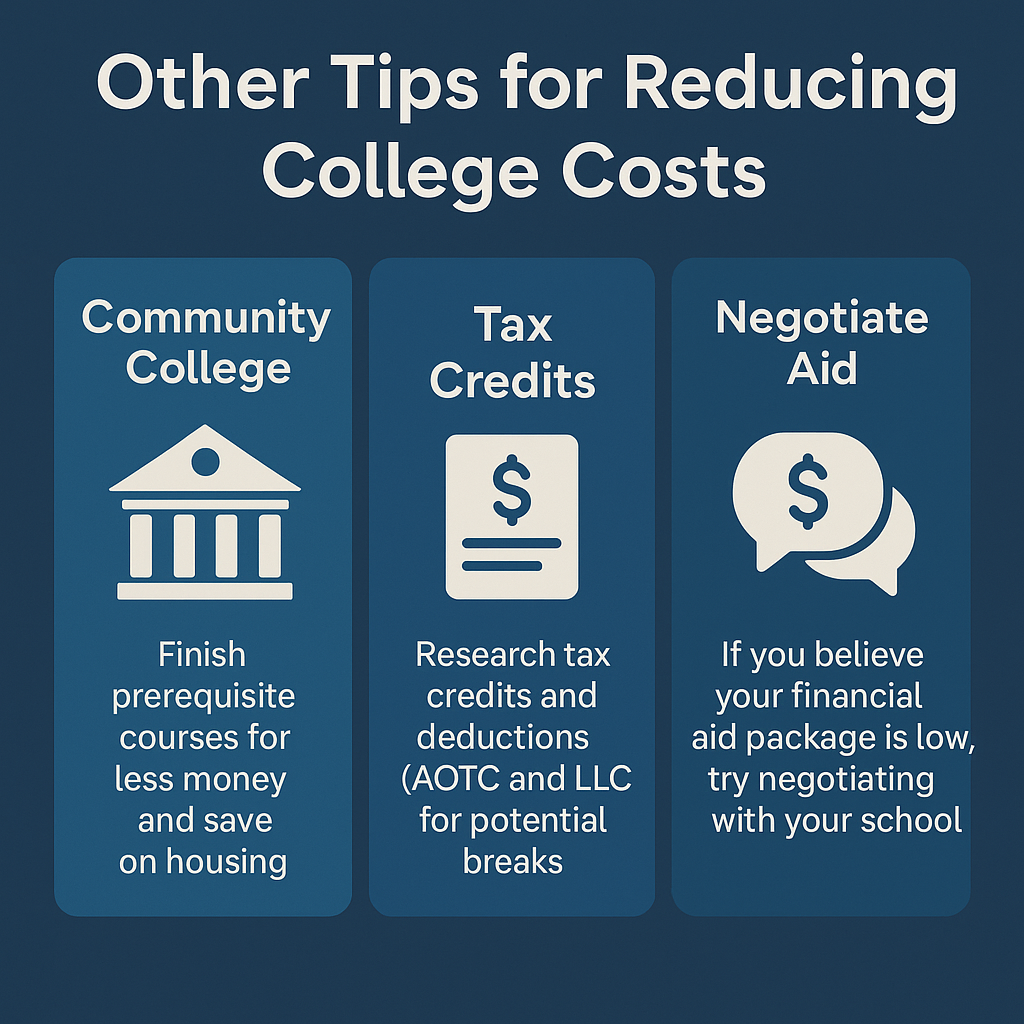

Looking for more ways to reduce the cost of college? Here are a few college financial aid tips to consider.

- Explore community college pathways and transfer options. You can often attend a local community college for significantly less money, where you can get your required courses taken care of, and then head to a four-year institution to complete your degree. Another benefit of attending a community college is that you can live at home, further decreasing your expenses.

- Take advantage of tax credits and deductions. There are two educational credits to consider: the American Opportunity Tax Credit (AOTC) and the Lifelong Learning Credit (LLC). Look into both of these to see whether you’re eligible to claim them on your tax return.

- Negotiate financial aid packages with institutions. Ask about additional scholarships or tuition discounts. If the financial aid package you’re offered seems low, you may be able to appeal it. Consult with your financial aid office for guidance if you plan to pursue this route.

- Use a financial aid calculator. This tool can help you understand your costs at a higher level. Many families underestimate how much grant and scholarship aid they can receive from universities — especially more competitive ones. They also tend to overlook the unique financial offerings that each school has to offer. Using a financial aid calculator gives you the most accurate sense of spending so you’re fully prepared for the journey ahead. In many cases, colleges offer a financial aid calculator specific to their school as a free tool to help you plan.

Conclusion

College is expensive, but a comprehensive financial aid strategy can help decrease your overall out-of-pocket costs. The best way to maximize your financial aid is to be proactive, plan carefully, apply early, and use all available resources. With the proper plan in place, you can decrease your reliance on student loans and graduate with less, or no, debt to your name.

About our content reviewer

Daniel Kyong is a founding partner of Educo. A Princeton University graduate, he brings over a decade of experience in test prep and college admissions. Before Educo, Daniel worked with national test prep companies like PrepScholar, Cardinal Education, and Summit, where he led curriculum design and tutoring. At Educo, he serves as its Chief Education Officer, building a new standard for tutoring grounded in true expertise, care, and results.

Our Editorial Team, with a rich background in educational content creation, prioritizes accuracy and quality in every article. We are committed to producing expert content tailored to meet the academic needs of college and high school students, ensuring they receive well-researched and trustworthy information for their educational journey.