The opinions expressed in this article are the author’s own and do not reflect the view of Pathward,® N.A.

The Bold Visa® Debit Card is a debit card with a unique focus on benefiting students. Designed by Bold.org, the card allows students to earn points through their everyday spending, which can be redeemed for cashback or applied toward student loans at an even better redemption rate.1 This rewards system is tailored to help students not only manage their finances more effectively but also reduce their student debt.

The Bold Debit Card combines convenience with a student-friendly approach to financial management, aligning with Bold.org’s mission to make education more affordable. By offering a practical way to earn rewards1 while managing daily expenses, the Bold Debit Card supports students in their educational and financial goals.

If you’re exploring ways to better manage your finances or looking for strategies to lessen your student debt, the Bold Debit Card could be a practical option to help with your educational costs. In this article, I’ll walk you through everything you need to know about the Bold Debit Card, from its key features to its customer support services, user reviews, and more. Let’s get started.

To learn more about the Bold Debit Card and the scholarship opportunities available on Bold.org, visit Bold.org and start exploring ways to fund higher education.

What Is the Bold Debit Card?

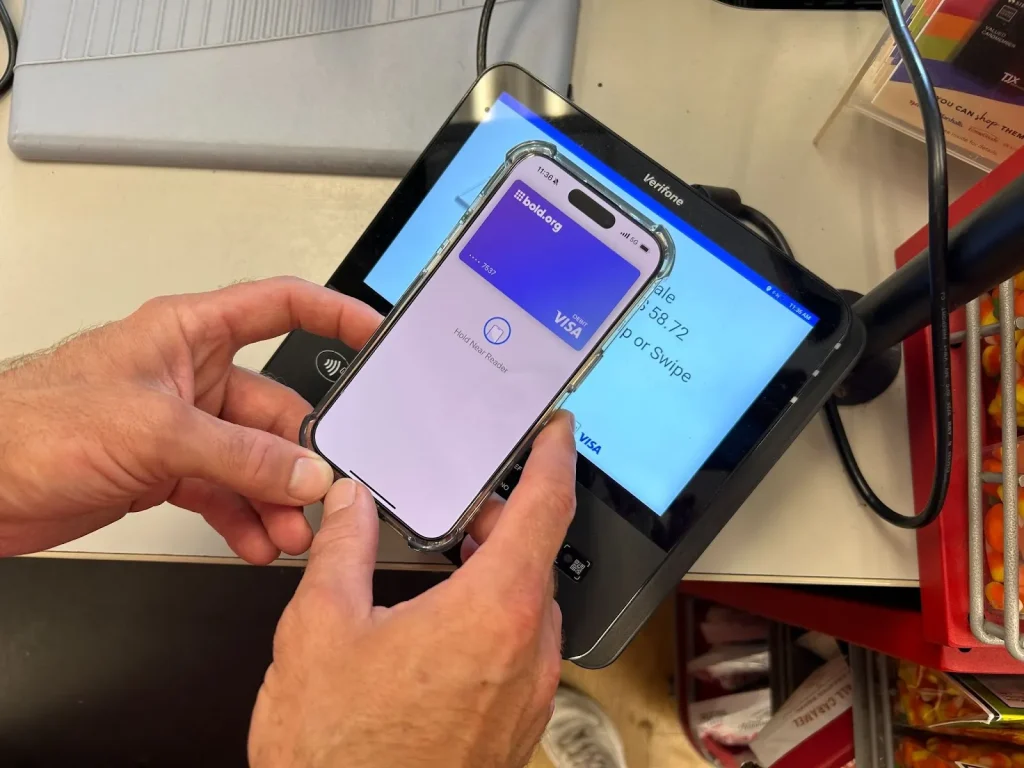

The Bold Debit Card is a demand deposit account designed for students and graduates that allows them to earn Bold Points1 for everyday spending. Students can use it to make purchases in stores or online and have the benefit of contactless payments by adding it to their mobile wallet through the Bold Mobile App.

With the Bold Debit Card, students are able to earn Bold Points that help them pay for school. It is super convenient for students to view their transactions and track their Bold Points earned on their Banking Dashboard, which they can view once they are logged in or in the Bold Mobile App. These points can be redeemed for cashback or student loan payments, which helps students reduce their college costs.

Learn more about the Bold Debit Card directly through Bold.org’s website.

Who Should Use the Bold Debit Card?

The Bold Debit Card is ideally suited for teens and students, recent graduates dealing with student debt, and young adults just beginning to take charge of their finances. Tailored specifically for students and graduates, the Bold Debit Card is a great tool for those working toward their educational and financial objectives. Whether you’re buying textbooks, paying bills, or just covering daily expenses, this debit card helps you manage your money while rewarding your spending habits.

It offers a straightforward way to earn Bold Points1 on everyday purchases, with opportunities to earn more Bold Points through scholarship opportunities on their website, inviting friends, and more. Bold Points earned can then be redeemed for cashback or used to help pay student loans.

About Bold.org

Bold.org is a scholarship and student banking platform dedicated to fighting student debt by increasing access to education through scholarships and financial resources, aiming to help address the student debt crisis. Known for its transparency and impact, Bold.org connects students with scholarship opportunities and enables donors to create personalized scholarship funds.

By offering the Bold Debit Card, Bold.org extends its educational mission into personal finance, providing a safe and secure debit card that helps users work toward their financial and educational goals.

Key Features of the Bold Debit Card

Main Features2

- No Annual Fees: No charges for maintaining an account, making it cost-effective for students.

- No Foreign Transaction Fees, Hidden Fees, or Credit Limit Fees: Enjoy transparent pricing with no extra charges for international purchases or hidden fees.

- Rewards System: Earn Bold Points on everyday eligible purchases that can be redeemed for cashback or applied toward student loan payments. $2 = 1 Bold Point.

- Student Loan Benefits: Enhanced redemption rate when Bold Points are used to pay down student loans. 100 Bold Points = $1 cashback or $1.5 student loan payments.

- Early Pay3: Users can get paid up to two days earlier and earn extra time to grow their savings.

Learn more: Get Paid Earlier with the Bold Debit Card - Mobile App Integration: Easy access to account management, transaction history, and rewards tracking through a user-friendly app.

- Smart Transfer4: Automatically top up your balance when it gets low. You can select an amount to transfer and the amount at which it should initiate this transfer.

- Receive Bold.org Scholarships on the Bold Debit Card5: When you win Bold.org scholarships, you can receive them on the Bold Debit Card, giving you more options on how to spend your scholarships.

Learn more: Receive Scholarships on the Bold Debit Card - No Minimum Balance Requirement: No pressure to maintain a certain balance, allowing for flexibility in spending and saving.

- Apple Pay® and Google PayTM: Ability to connect the debit card to digital wallets creates a more seamless transaction experience.

Explore the Bold Debit Card features in-depth here.

Security

- Fraud Protection: Advanced monitoring to detect and prevent unauthorized transactions.

- Secure Encryption: Encryption technology to safeguard personal and financial information.

- Instant Card Locking: Ability to instantly lock the card via the mobile app or online banking dashboard if it is lost or stolen.

- Alerts and Notifications: Real-time alerts for transactions to keep users informed of account activity.

- $250k FDIC Insurance6: The FDIC insures your deposits at banks and savings institutions that have FDIC insurance, with coverage up to $250,000 for each depositor.

Accessibility

- Online Banking Dashboard: User-friendly web interface for easy account management, transaction monitoring, and rewards tracking.

- Mobile App: Convenient app access for managing the card, viewing transaction history, and redeeming rewards on the go.

- 24/7 Customer Support: Accessible support via phone or email to assist with account-related inquiries and issues. Contact the Bold customer service team at 833-238-7992 or contact@bold.org.

- Instant Card Activation: Quick and easy activation process through the mobile app or online dashboard.

- Account Alerts: Customizable notifications for transactions and account updates to keep users informed.

Benefits of the Bold Debit Card

Here’s how the Bold Debit Card can make a difference:

- Financial Flexibility: With no monthly fees or minimum balance requirements, students can manage their finances without worrying about extra charges or maintaining a specific balance.

- Rewarding Everyday Spending: Students are earning Bold Points1 on everyday purchases such as spending at grocery stores or gas stations, which can be redeemed for cashback or used to pay down student loans.

- Student Loan Assistance: The debit card’s rewards1 can be applied directly to student loan payments at a favorable redemption rate, providing an additional tool to manage and reduce student debt.

- Easy Account Management: The Bold Mobile App and online Banking Dashboard offer convenient access to manage accounts, track transactions, and monitor rewards, making it easier for students to track their spending and rewards on their Bold Debit Card.

- Security and Peace of Mind: With features like fraud protection, secure encryption, and instant card locking, students can confidently use their debit card knowing their financial information is well-protected.

- No Hidden Fees: The absence of foreign transaction fees, hidden fees, or credit limit fees ensures that students can use their debit card without encountering unexpected costs, which is particularly useful for managing spending both locally and abroad.

Discover other great benefits of the Bold Debit Card here.

How to Get the Bold Debit Card

Applying for and receiving the Bold Debit Card is a simple and streamlined process. In fact, many users have commented on the application and activation process as one of its most convenient features.

- Create an Account: Visit the apply page on Bold.org and create a free applicant profile. Upon account opening, users can also access thousands of exclusive scholarships available on Bold.org.

- Start an Application: Navigate to the Banking tab and apply for the Bold Debit Card.

- Fill in Required Information: Provide basic details such as legal name, SSN, and address. Additionally, review and accept necessary documents, including terms and conditions.

- Approval Status: After submitting the required information, the application status will be communicated immediately.

- Link a Bank Account: Enter basic account details and connect a bank account to the Bold Debit Card. You’ll earn more Bold Points by completing this onboarding milestone.

- Download the Bold Mobile App: For convenience, download the Bold Mobile App to access various features from a smartphone.

- Receive the Bold Debit Card: The Bold Debit Card will be delivered within 5-7 business days. You can use your virtual card while you wait for your physical card by adding it to your mobile wallet.

Learn how you can combine scholarship funds with the Bold Debit Card to maximize rewards.

User Reviews & Feedback

User reviews offer valuable insights into the Bold Debit Card’s performance and user experience. This section summarizes general sentiments and highlights key points from user feedback, helping potential cardholders gauge how well the debit card meets their needs and expectations.

Favorite Features

“I really like that I can use points for cashback or student loans. I also appreciate how Bold.org helps students by offering scholarships.” – Jeremy J.

“I liked the reward features that help pay down my student loans.” – Bryan.

Overall Experience

“Overall, my experience with the card has been great.” – Amanda B.

“I’ve utilized it for in-person chip and contactless payments, as well as online, sometimes all in the same day, and have had no problems. The account and routing number can be linked to a Venmo account and you have an added flexibility with the movement of funds. It’s definitely earned free money. I’ve only utilized the Cashback redemptions so far, and it’s incredibly lovely, it gives one the incentive and motivation to pursue more Bold Points.” – Julio V.

“I use Bold.org like crazy during the school year. It seemed like a no-brainer to get the card. I mean, who doesn’t like accumulating points for money?” Dawna C.

The testimonials featured were gathered from interviews with Bold.org users who actively use the Bold Debit Card. The personal experiences of these individuals are shared to provide insights into the functionality and user experience of the Bold Debit Card. Individual experiences may vary. No student received compensation to endorse the Bold Debit Card.

Dive into a practical guide on financial education for teens to ensure you’re making informed decisions about your finances.

Frequently Asked Questions About the Bold Debit Card

Can the Bold Debit Card Be Used Internationally?

Yes, the Bold Debit Card can be used internationally. Additionally, there are no foreign transaction fees or hidden fees assessed by the Bold Debit Card.

Is the Bold Debit Card a Good Option for Non-Students?

The Bold Debit Card is primarily designed with students in mind. However, those who are no longer students and have graduated with student debt can also benefit from the Bold Debit Card’s no hidden fees, rewards* on everyday purchases, redemption options for student loan payments, and security features.

How Can I Track My Rewards1 with the Bold Debit Card?

You can track your rewards through the Bold Mobile App or the online Banking Dashboard, which provides detailed insights into your Bold Points earned, available balance, and options for redemption.

Are There Other Ways to Earn Bold Points1 on Bold.org?

Yes. You can earn Bold Points by interacting with the platform, applying for scholarships, inviting friends, filling out surveys, nominating others for scholarships, etc.

If there are still questions left unanswered, check out Bold.org’s scholarship blog, which is home to articles about student finance, college life, and education, or contact Bold.org.

Bold.org Visa® Debit Card is a demand deposit account provided by Pathward®, N.A., Member FDIC. Bold.org Visa Debit Card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card can be used everywhere Visa debit cards are accepted. Visa is a registered trademark of Visa U.S.A. Inc. All other trademarks and service marks belong to their respective owners. Register your Card for FDIC insurance eligibility and other protections.

1 This offer is not a Pathward product or service. Pathward does not endorse this offer.

2 The features associated with the Bold Debit Card discussed in this blog post are provided by Bold.org and are not affiliated with our Bank partners, Pathward®, or Visa.

3 Early direct deposits will generally be posted on the day they are received, which may be up to two business days prior to the scheduled payment date. Some direct deposits may not be eligible for Early Pay. Early Pay may be delayed due to fraud prevention screening, system processing, or account restrictions. Get in touch at contact@bold.org with any Early Pay questions.

4 Smart Transfer is a service offered by Bold.org and is not affiliated with our Bank partners/Pathward®. The service automatically initiates a transfer when the user’s account balance reaches the specified threshold, but it does not guarantee an immediate deposit of funds. Transfer times are subject to standard processing periods.

5 Receiving a scholarship on the Bold Debit Card is a service provided by Bold.org and is not affiliated with our Bank partners/Pathward®.

6 Funds are FDIC insured, subject to applicable limitations and restrictions, once Pathward receives the funds deposited to your account. For more specific and up-to-date information about coverage and limitations, see the FDIC website.

Michael Alexander

Michael's experience with scientific research foundations informs his work at Scholarship Institute, where he leverages his strong research background to provide valuable insights across various fields. Specializing in review articles on scholarships, particularly in STEM, he ensures that students receive well-informed content to effectively navigate their financial options.